Innovation — one of the most overused words in business — yet its meaning and impact remain murky. Manufacturing industries invest enormously in innovation, but the end products rarely land as intended - and some never land at all.

Is there a disconnect?

Why do the best ideas lose momentum before they reach the market?

They sit in folders, gathering dust as long research and development (R&D) cycles delay feedback, and siloed teams struggle to integrate customer input—while faster-moving competitors can gain the upper hand. In Asia Pacific, more than 70% of the global manufacturing community report being stuck in pilot purgatory.

That’s the innovation gap—and it’s only widening as regional pressures mount, with megatrends pointing to enormous opportunities in electrification, hydrogen, and robotics.

The Asia-Pacific electric vehicle (EV) market is projected to grow from USD 196 billion in 2022 to USD 839 billion by 2030², while regenerative manufacturing is expected to reach USD 1.2 trillion by the same year³. Those who can’t bring customer needs into R&D quickly are falling behind in both performance and sustainability. Why does it remain so difficult to make customer-centric innovation a reality?

The problem isn’t ambition or creativity—it’s the fragility of the innovation pipeline.

Why the Innovation Pipeline Feels Fragile

It’s slow. It’s expensive. And too often, it’s disconnected from the very people it’s supposed to serve: the customers.

Developing a new product can take years, slowed by regulatory hurdles and risk-averse cultures—only to reach market after the moment has passed. Adding to the innovation pipeline’s fragility are the entrenched silos that resist cross-functional collaboration between teams. Some manufacturers further compound this fragility by falling in love with their own technology or pursuing the allure of disruption in megatrends—pushing a breakthrough simply because they can, rather than because it solves real problems.

When the focus is too narrow on engineering excellence, manufacturers risk underestimating how timing, usability, or sustainability affect adoption. The result is innovation that falters because it isn’t grounded in real market needs. Closing this gap requires a rethink of the environments where innovations are built.

Redefining Innovation Around the Customer

Innovation only becomes truly customer-first when it is nurtured in ecosystems where universities, start-ups, industry partners, and policymakers work in symbiosis. By collaborating from day one, these stakeholders ensure that customer insight is baked into the earliest stages of research—strengthening the innovation pipeline and giving manufacturers a foundation for innovation that stays market-relevant.

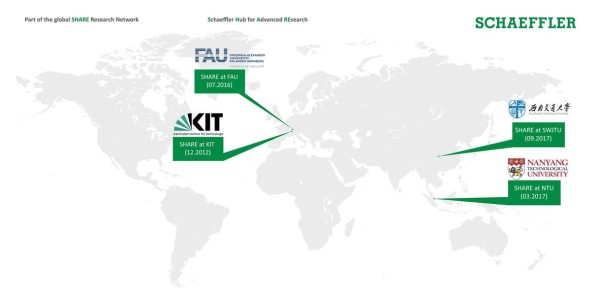

Joint labs and start-up partnerships have become critical nodes in this ecosystem, providing manufacturers with the testbeds they need to trial prototypes in real-world settings and ensure research evolves in step with customer demand. A case in point is the Schaeffler Hub for Advanced Research (SHARE) at NTU, supported by policymakers, which develops applied solutions with the customer firmly at the center.

Academia and Policy: Shaping Future Innovations

Here, future innovations are already taking shape. Projects in collaborative robotics are advancing high-precision sensing and torque control to meet the growing need for safer human-robot interaction in next-generation factories. Work on automated mobile robot (AMR) platforms combines mechatronics, sensor fusion, and software to deliver agile robots that can adapt to increasingly complex shopfloors. Meanwhile, research into industrial IoT for smart factory applications leverages AI, digital twins, and metaverse tools to give operators the real-time intelligence they need to run more efficient and resilient production lines.

In other words, SHARE is not just “doing research” for its own sake. It is addressing emerging frontline problems with practical, deployable solutions that begin with the customer and extend all the way through research, prototyping, testing, and scaling. Collaborations like this strengthen the innovation pipeline by ensuring every step remains grounded in what customers actually require—today and tomorrow.

But ecosystems don’t thrive on research labs alone. Speed and agility matter just as much, and that’s where startups come in.

Startups: The Missing Speed in Customer-First Innovation and Policy

Startups are critical to the ecosystem because they bring agility where traditional R&D is slow. Their speed matters: it closes the gap between shifting customer needs and slow corporate R&D cycles. This is evident in programmes such as STARTUP AUTOBAHN, which connects manufacturers to thousands of emerging companies in mobility, production, and digitalization.

Partnerships from this network are already delivering results. AI-based systems, for example, are digitalizing toolmaking by automating design, planning, and programming steps—cutting quotation preparation times by as much as 80 percent. Outcomes like these directly address what customers in manufacturing demand most: shorter lead times, lower costs, and greater flexibility for customized solutions. This is customer-centric innovation in action.

For manufacturers, the lesson is clear: the surest way to mature ideas today is within a broader ecosystem that combines the agility of startups, the discipline of academia, the scale of industry, and the guidance of policymakers in one framework.

After all, lasting innovation is customer-centric innovation—and the same principle is now reshaping other frontiers, from smart factories to the electrification of two-wheelers in Asia.

This kind of cultural shift doesn't happen overnight, but when it does take hold, it's remarkably powerful. Because the people closest to the challenges are often best positioned to solve them—they just need the right tools and perspective to see the possibilities.

Customer-First Innovation in Action

In the dense cities of India and Southeast Asia, there is a race to electrify two-wheelers. Scooters and motorbikes are the most practical way to move through the streets for millions in the region. While rising fuel costs and government incentives are moving the needle on electric vehicle (EV) penetration, the promise of electrification is still stuck in traffic with two stubborn realities: cost and reliability. Riders need machines they can afford, while OEMs need technology that meets the local population’s needs in long commutes.

This is where customer-centric, joint development models are making a difference. By working alongside local OEMs, suppliers are tailoring drive systems for both affordability and a high degree of control accuracy to survive local traffic patterns. After all, the continuous stop-and-go traffic environment in a city choked with motorbikes tells a different story from a laboratory benchmark. The result is an electric drive system that is not only technically viable, but also robust and cost-efficient for everyday riders. For regional OEMs, this demonstrates that affordability and reliability are the real levers of EV adoption in Asia’s two-wheeler market — not just technology leadership. Those who can meet the everyday commuter’s needs will set the pace of electrification in the region.

And this principle goes beyond mobility. Rail and heavy industry across Asia-Pacific are also under pressure, as operators face rising costs, tighter timelines, and scrutiny over carbon footprints. That’s why more manufacturers are looking beyond new components to co-creation models and circular practices that extend asset life while reducing risk.

Customer-First Innovation in Action

In the rail sector, co-creation shows up in partnerships like the Alstom Alliance™, where technology suppliers and OEMs work together to extend lifecycle value. Instead of only producing new components, these collaborations are delivering circular practices such as bearing reconditioning—capable of saving up to 95% in resources for rail operators. For Asia’s rail and heavy industry operators under pressure to cut costs and carbon, this circular practice does more than improve efficiency; it helps them meet both sustainability and profitability requirements.

The impact extends past the railway tracks too. In heavy industry, safety and uptime are daily concerns. With plants under pressure to shorten maintenance windows and reduce risks, customer-centric co-development has introduced new mounting technologies that improve turnaround times and raise safety standards in cement plants. These solutions have replaced slower, risk-prone methods like blowtorches—meeting operators’ need to protect their people while keeping production running.

And the momentum isn’t stopping here. Across Asia Pacific, manufacturers are pushing into new frontiers with customer-centric co-creation as their engine.

The Wheels Keep Turning in APAC

With eyes on the horizon, manufacturers in the region are pushing into new frontiers – from electrified mobility and autonomous transport to advanced manufacturing and AI-enabled production. Success in this next phase will depend on embedding co-creation into R&D—bringing in universities, start-ups, and government to shorten feedback loops and validate ideas in real-world conditions, moving beyond pilots to create lasting industry impact.

Because lasting innovation is customer-centric innovation. It comes from listening closely to customers, collaborating across the ecosystem, and validating solutions in-market.

Ultimately, good ideas rarely fail because they are flawed. They fail because they are not tested in the customer’s reality. Those who overcome this barrier will be best placed to navigate mobility, energy, and Industry 4.0 in an environment defined by constant disruption.