Schaeffler Group closes 2022 with solid earnings

2023-03-07 | Herzogenaurach | Singapore

- Schaeffler Group revenue up 9.4 percent at constant currency to 15.8 billion

- EBIT before special items of 1,046 million euros results in EBIT margin before special items of 6.6 percent

- Free cash flow of 280 million euros

- Proposed dividend of 45 cents per common non-voting share

- Cautious outlook for 2023

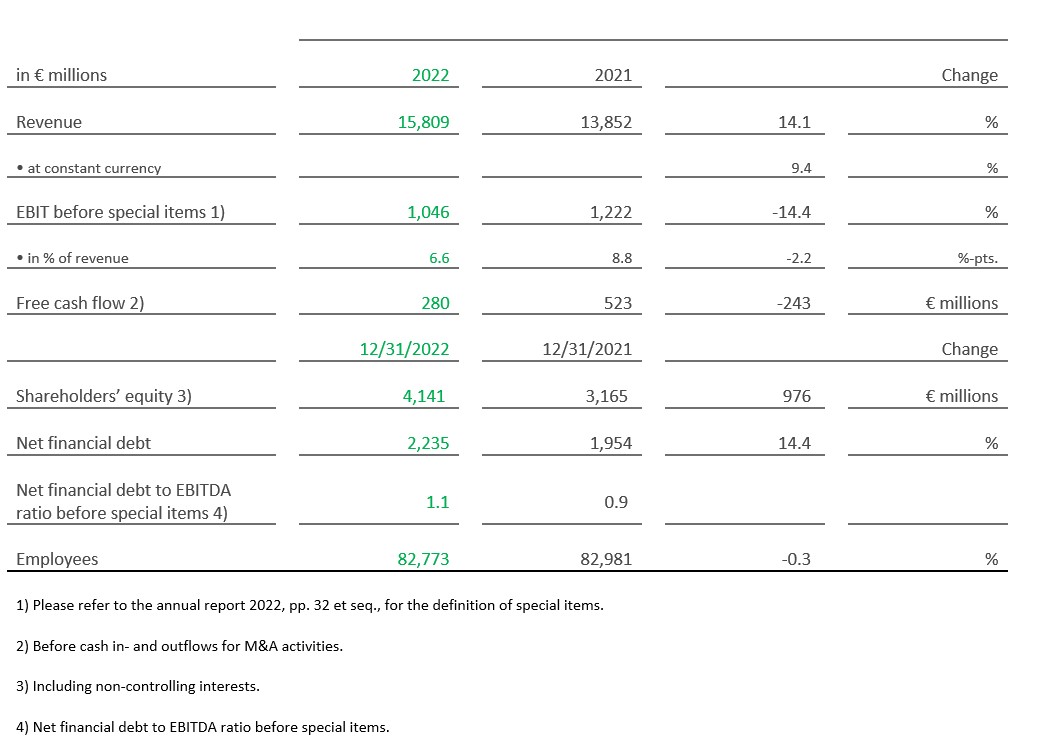

Global automotive and industrial supplier Schaeffler presented its results for 2022 today. The Schaeffler Group’s revenue for the reporting period amounted to 15.8 billion euros (prior year: 13.9 billion euros). At constant currency, revenue was up 9.4 percent, exceeding the guidance. The year was characterized by considerable revenue growth, which was largely attributable to an increase in volumes in the Automotive Technologies and Industrial divisions. Favorable price realization in all three divisions further bolstered the revenue trend as considerable increases in procurement costs were increasingly passed on to the market.

In 2022 the Schaeffler Group generated earnings before financial result and income taxes (EBIT) of 974 million euros (prior year: 1,220 million euros), a figure that was affected by 72 million euros in special items. EBIT before special items amounted to 1,046 million euros (prior year: 1,222 million euros). This represents an EBIT margin before special items of 6.6 percent (prior year: 8.8 percent), which was at the upper end of the guidance despite the challenging environment. The EBIT margin before special items declined predominantly due to higher material and energy prices, disrupted global supply chains, and market- and environment-based inefficiencies.

Net income attributable to shareholders of the parent company amounted to 557 million euros for the reporting period, following 756 million euros in the prior year. Earnings per common non-voting share were 0.84 euros (prior year: 1.14 euros).

On that basis, the Board of Managing Directors and the Supervisory Board will propose a dividend of 45 cents per common non-voting share (prior year: 50 cents) to the annual general meeting. This represents a dividend payout ratio of approximately 48 percent (prior year: approximately 44 percent) of net income attributable to shareholders before special items of 610 million euros (prior year: 748 million euros).

Key financials – Schaeffler Group

Automotive Technologies – 5 billion euros in order intake at E-Mobility

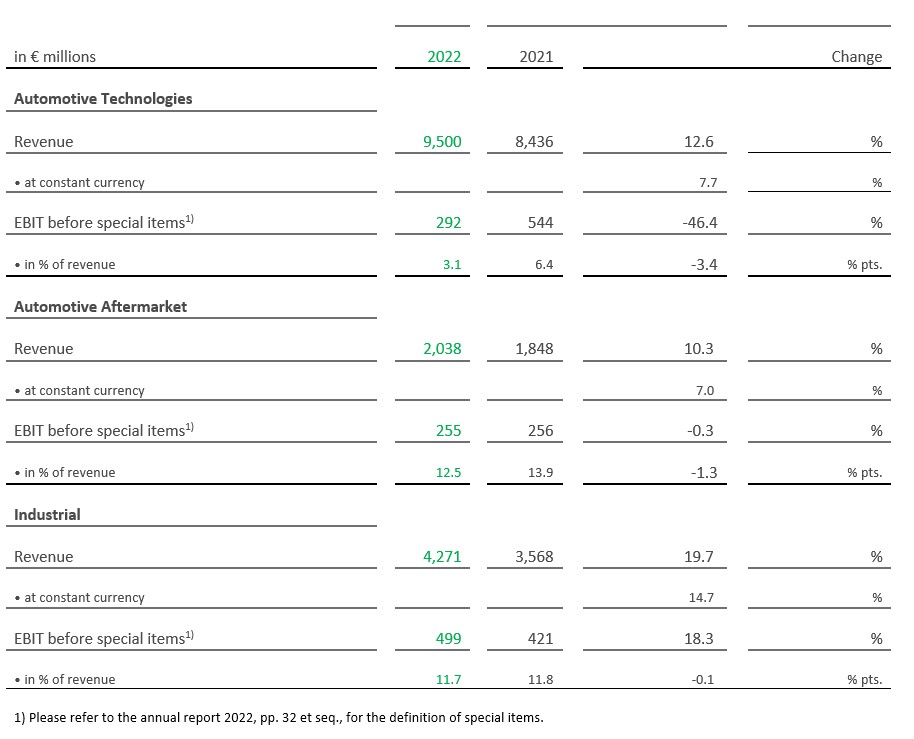

The Automotive Technologies division generated 9,500 million euros in revenue (prior year: 8,436 million euros). At constant currency, revenue increased by 7.7 percent from the prior year. The growth in revenue during the year was mainly due to higher volumes resulting from a market-driven increase in demand.

In total, the Automotive Technologies division outperformed global automobile production of passenger cars and light commercial vehicles by 1.5 percentage points driven by the positive contributions from the Europe and Americas regions.

E-Mobility and Chassis Systems experienced especially strong growth throughout the reporting period due to trends in their specific markets, with both a market-driven increase in volumes and product ramp-ups contributing to the high growth rates. One important milestone here was the start of production of the first rear-wheel steering system in 2022. The Europe region increased its revenue by 11.8 percent at constant currency and grew the most in absolute terms. In the Americas and Asia/Pacific regions, revenue was up 14.1 percent and 4.5 percent at constant currency, respectively, while the Greater China region reported a constant-currency decline of 1.4 percent.

The E-Mobility business division increased its order intake to 5.0 billion euros. The division as a whole won 12.3 billion euros in orders.

EBIT before special items amounted to 292 million euros (prior year: 544 million euros). The EBIT margin before special items was 3.1 percent (prior year: 6.4 percent).

Automotive Aftermarket – Revenue increases to more than 2 billion euros

The Automotive Aftermarket division delivered 2,038 million euros (prior year: 1,848 million euros) in revenue in 2022. Mainly driven by favorable price realization, revenue rose by 7.0 percent at constant currency, a significant part of the considerable increase in procurement costs was passed on to the market through sales price adjustments.

Europe region revenue grew by 6.4 percent at constant currency. Overall, the considerable decline in volumes in the Independent Aftermarket business in the Central & Eastern Europe subregion due to the war in Ukraine was more than offset by higher volumes in the Western Europe and Middle East & Africa subregions in 2022. In the Americas, Greater China, and Asia/Pacific regions, revenue was up 6.5 percent, 6.7 percent, and 16.4 percent, respectively, at constant currency.

EBIT before special items of 255 million euros was flat with prior year (prior year: 256 million euros). The decrease in EBIT margin before special items to 12.5 percent from the prior year (13.9 percent) was primarily due to higher selling expenses, which were partly attributable to favorable one-off items in the prior year. As adjustments to sales prices largely offset considerably increased procurement costs, a gross margin at the level of the prior year was achieved.

Industrial division – Strengthened by acquisitions

The Industrial division once more increased both revenue and earnings in 2022. Its revenue of 4,271 million euros (prior year: 3,568 million euros) represented constant-currency revenue growth of 14.7 percent. This growth was mainly driven by volume increases in the Europe region and, globally, by Industrial Distribution and in the Industrial Automation sector cluster. The division’s highest revenue levels overall were reported by the Wind and Industrial Automation sector clusters.

In the Europe region, revenue was up 20.4 percent at constant currency, primarily driven by volume growth in the business with distributors (Industrial Distribution) and in the Industrial Automation sector cluster. In the Americas region, revenue rose by 11.6 percent at constant currency during the year, while the Greater China region generated 8.8 percent in additional revenue at constant currency compared to the prior year. The additional revenue in the Greater China region resulted primarily from increased volumes in the Raw Materials and Industrial Automation sector clusters. In the Asia/Pacific region, revenue increased by 13.2 percent at constant currency, mainly due to volume growth in the business with distributors (Industrial Distribution) and in the Two Wheelers sector cluster.

EBIT before special items rose by 18.3 percent to 499 million euros (prior year: 421 million euros). The EBIT margin before special items amounted to 11.7 percent (prior year: 11.8 percent).

Focused acquisitions were made during the year to further strengthen the Industrial division, primarily in the Industrial Automation sector cluster. The acquisition of Melior Motion GmbH (since December 1, 2022: Schaeffler Ultra Precision Drives GmbH) further expands the division's portfolio and market position in the high-growth field of robotics. Additionally, the linear business was significantly strengthened by the acquisition of the Ewellix Group, which closed on January 3, 2023. The Ewellix Group is a leading global manufacturer and supplier of drive and linear motion solutions. Its core products are used in a wide range of applications and equipment including medical technology, mobile machinery, assembly automation and robotics, and various other areas of industry. In a transaction that closed on December 1, 2022, the Schaeffler Group acquired 100 percent of the shares of CERASPIN S.à.r.l., expanding the Industrial division’s technology portfolio in the area of high-quality ceramic components mainly used in strategic growth areas.

Key financials – Schaeffler Group divisions

Free cash flow before M&A of 280 million euros – Strong balance sheet and liquidity position

The Schaeffler Group’s free cash flow before cash in and outflows for M&A activities of 280 million (prior year: 523 million euros) met the guidance while including higher capital expenditures. Capital expenditures (capex) on property, plant and equipment and intangible assets rose to 791 million euros during the reporting period (prior year: 671 million euros), representing a capex ratio of 5.0 percent (prior year: 4.8 percent). The reinvestment rate amounted to 0.88 (prior year: 0.74).

Net financial debt increased to 2,235 million euros as at December 31, 2022 (December 31, 2021: 1,954 million euros). The gearing ratio, i.e., the ratio of net financial debt to shareholders’ equity, declined to 54 percent (December 31, 2021: approximately 62 percent). The Schaeffler Group, which had approximately 14.3 billion euros in total assets as at December 31, 2022 (prior year: approximately 14.4 billion euros), employed a workforce of 82,773 as at that date (prior year: 82,981), a slight reduction of approximately 0.3 percent.

Claus Bauer, CFO of Schaeffler AG, says, “In a difficult environment, Schaeffler has met all group-level financial targets set for 2022. Despite higher capital expenditures for product ramp-ups and capacity expansions, for instance, as well as a sales-driven increase in inventories, we have generated solid free cash flow.”

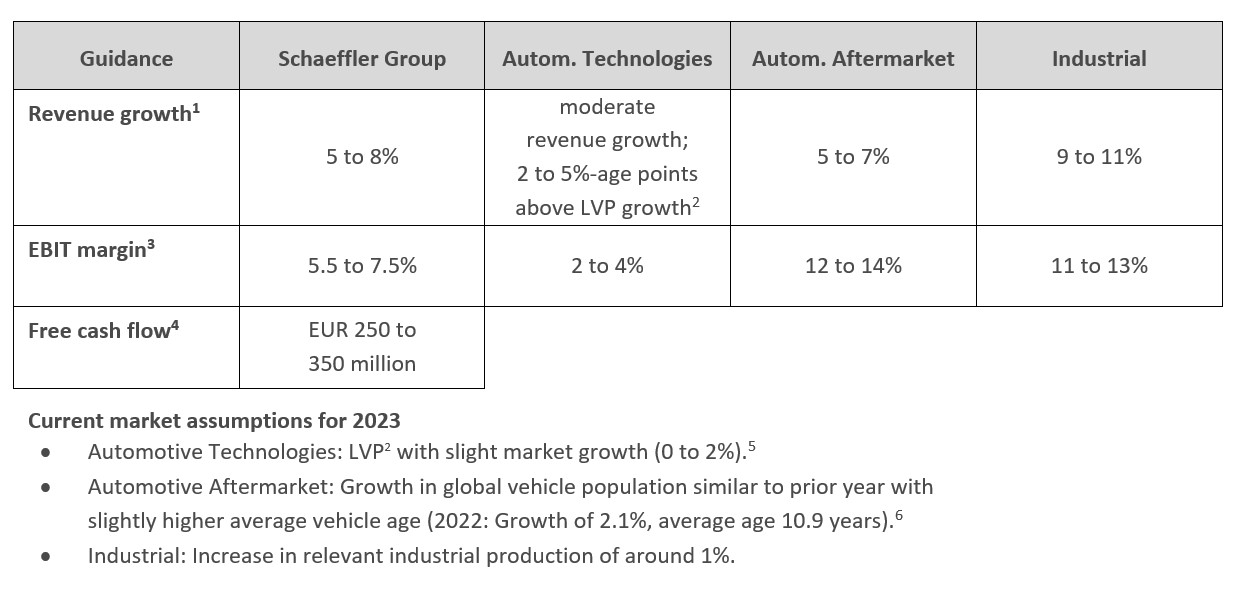

Cautious outlook for 2023

The Schaeffler Group expects its revenue to grow by 5 to 8 percent at constant currency in 2023. In addition, the company expects to generate an EBIT margin before special items of 5.5 to 7.5 percent in 2023. This expectation reflects, in particular, higher year-on-year wage increases and energy costs affecting all divisions. Moreover, the Schaeffler Group anticipates free cash flow before cash in and outflows for M&A activities of 250 to 350 million euros for 2023.

“The Schaeffler Group has once again demonstrated resilience in a challenging environment in 2022 and generated solid results. All divisions and all regions grew, with the substantial contribution by the Industrial division especially worth highlighting,” says Klaus Rosenfeld, CEO of Schaeffler AG. And further, commenting on the business of the divisions: “We are resolutely pushing ahead with the transformation of the Automotive Technologies division. The E-Mobility order intake of 5 billion euros in 2022 speaks for itself. Automotive Aftermarket is profiting from current market conditions. In our Industrial division, we have supplemented our considerable global organic growth with acquisitions. Sustainability and digitalization remain of key strategic importance to the Schaeffler Group.”

You can find our annual report here: www.schaeffler-annual-report.com

Our digital press kit is available here: www.schaeffler.com/apc

1 at constant currency

2 LVP growth: global growth in production of passenger cars and light commercial vehicles

3 before special items

4 before cash in- and outflows for M&A activities

5 Includes content supplied by S&P Global © [IHS Markit Light Vehicle Production Forecast (Base), January 2023]. All rights reserved.

6 Includes content supplied by S&P Global © [IHS Markit Vehicles in Operation (VIO) Forecast, November 2022]. All rights reserved.

Forward-looking statements and projections

Certain statements in this press release are forward-looking statements. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial consequences of the plans and events described herein. No one undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place any undue reliance on forward-looking statements which speak only as of the date of this press release. Statements contained in this press release regarding past trends or events should not be taken as representation that such trends or events will continue in the future. The cautionary statements set out above should be considered in connection with any subsequent written or oral forward-looking statements that Schaeffler, or persons acting on its behalf, may issue.

Publisher: Schaeffler (Singapore) Pte. Ltd.

Country: Singapore

Terms of use for Schaeffler press pictures

Schaeffler press pictures may only be used for editorial purposes. Unless otherwise stated, all copyrights and rights of use and exploitation are owned by Schaeffler Technologies AG & Co. KG, Herzogenaurach (Germany) or by one of its affiliated companies. The reproduction and publication of Schaeffler press pictures is only permitted if the source is stated as follows: "Image: Schaeffler". The pictures may be used free of charge in such cases. The use of pictures for advertising or other commercial purposes, in particular their disclosure to third parties for commercial purposes, is hereby prohibited. Pictures may only be edited with the approval of Schaeffler.

We kindly request that a specimen copy be sent to us when Schaeffler press pictures are published in printed media (or a digital copy in the case of publication in electronic media). When using Schaeffler press pictures in films, please notify us and state the title of the film.

Use and utilization of Schaeffler press pictures is subject to the substantive laws of Germany without its conflict of law provisions. The place of competent jurisdiction shall be Nuremberg, Germany.

Postal address:

Schaeffler Technologies AG & Co. KG

Corporate Communication

Industriestrasse 1-3

91074 Herzogenaurach

Germany

Press releases

Package (Press release + media)